Overview of the Interest Rate Cut

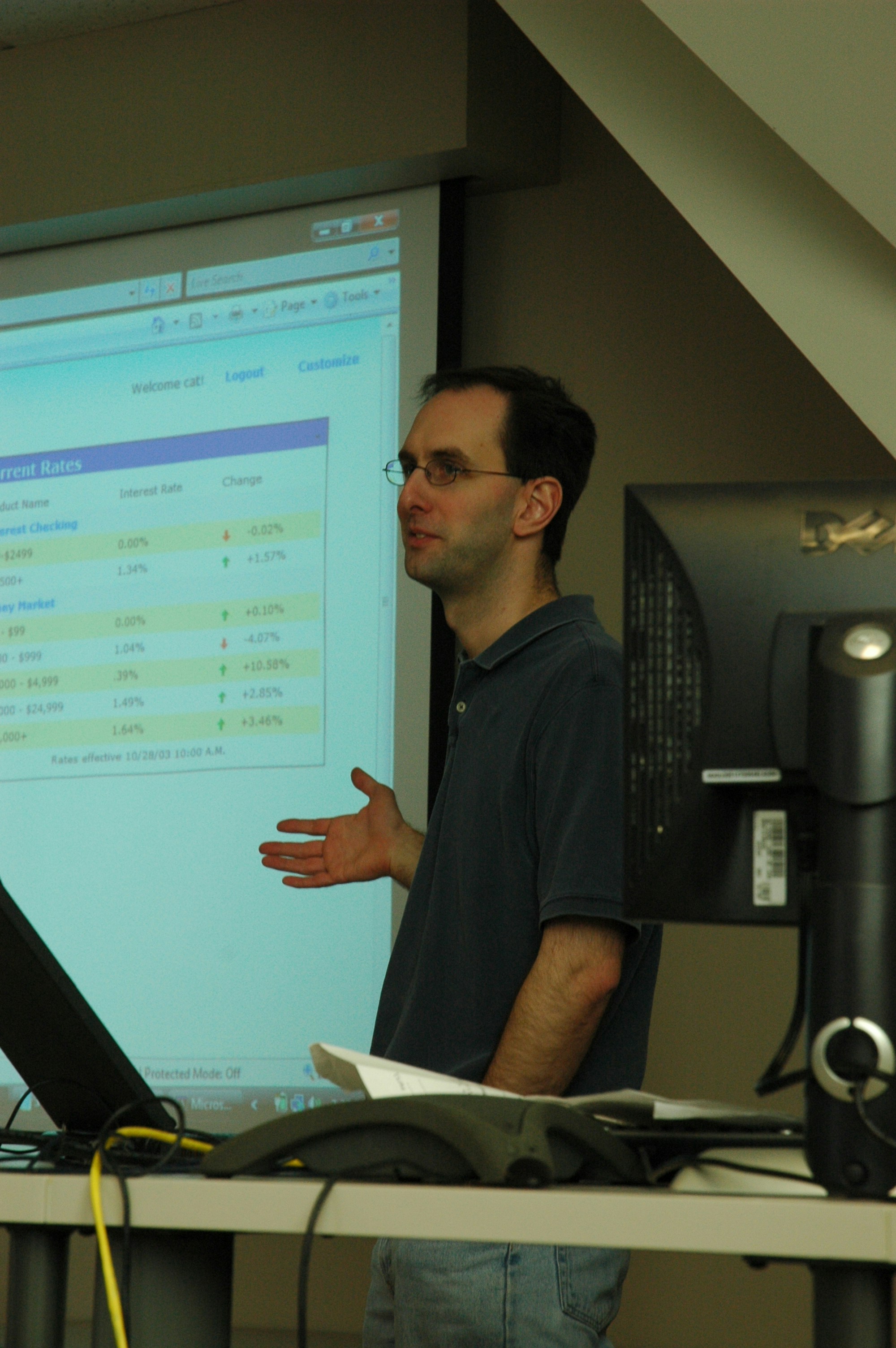

On October 29, the Federal Reserve announced a reduction in the base interest rate by 0.25 percentage points, bringing the new interest rate range to 3.75% – 4.00%. This decision marks the latest step in a broader monetary policy strategy aimed at addressing economic challenges faced by the nation. Prior to this rate cut, the Federal Reserve had been navigating a complex landscape characterized by inflationary pressures and fluctuating economic growth rates.

Leading up to this decision, the Federal Reserve had already implemented a series of interest rate cuts throughout the year in attempts to stimulate economic activity and support various sectors adversely affected by ongoing global disruptions. The initial indications of a slowing economy prompted Fed officials to reassess their stance on interest rates, resulting in a cumulative reduction aimed at encouraging borrowing and investment. These previous cuts have contributed to a more accommodative monetary environment, allowing consumers and businesses greater access to credit.

In the context of historical trends, this recent cut signals a strategic response to the evolving economic pressures. The decision also indicates a shift in the Federal Reserve’s focus towards fostering sustainable economic growth while balancing the risks of inflation. With the current interest rate range now adjusted, financial markets are observing how these changes may influence economic activity, including consumer spending and business investment. As participants in the economy adapt to this modified monetary landscape, the implications of this rate cut will continue to unfold, impacting the decisions of both consumers and investors alike.

Reasoning Behind the Rate Cut

The decision by the Federal Reserve to implement a reduction in interest rates stems from a confluence of economic indicators that suggest increasing vulnerabilities within the labor market and broader economic conditions. One of the primary motivations for this move is the noticeable slowdown in job creation, echoing concerns about a potential softening in consumer spending. This relationship is critical, as consumer spending constitutes a significant portion of economic activity. A decline in employment figures could lead to reduced disposable income and consumer confidence, ultimately hampering economic growth.

Moreover, the partial government shutdown has exacerbated uncertainty in the marketplace, leading to disruptions across various sectors. The Fed recognizes that prolonged interruptions in government services can negatively impact not just federal employees but also private sector businesses reliant on government contracts. As a result, the decision to cut rates is aimed at fostering an environment conducive to sustained economic growth during turbulent times.

Additionally, the Federal Reserve is closely monitoring inflation trends. In recent months, they have noted that inflation rates have remained below their target levels. By decreasing interest rates, the Fed seeks to stimulate borrowing and investment, which could help spur economic activity and ultimately drive inflation closer to the desired rate. This tool is particularly effective in stimulating economic engagement by reducing the cost of credit, thereby encouraging businesses to invest and consumers to spend.

In the context of these complexities, the Federal Reserve’s decision conveys a commitment to navigating the dual challenges of promoting economic growth while maintaining relative stability within the labor market. The ongoing adjustments reflect a proactive approach to managing potential risks that might hinder progress in the search for a balanced economic recovery.

Potential Impact on Different Economic Sectors

The recent decision by the Federal Reserve to cut interest rates has far-reaching implications across various sectors of the economy. As lower interest rates generally aim to stimulate economic growth, the potential impact on consumers, businesses, and the housing market warrants a thorough examination.

For consumers, reduced interest rates often translate into lower borrowing costs. This encourages increased spending, particularly on big-ticket items such as cars and appliances. With cheaper loans available, individuals may also consider refinancing existing debts, leading to reduced monthly financial obligations. This could result in higher disposable income, consequently boosting retail sales and overall economic activity.

In the realm of businesses, lower interest rates present an opportunity for enhanced capital investment. Companies can finance expansions and new projects at a lower cost, thus fostering innovation and potentially leading to job creation. Moreover, as borrowing becomes more affordable, small businesses may be more inclined to seek loans to invest in long-term development. This combination of increased borrowing and spending can contribute significantly to economic growth and stability.

The housing market stands to benefit as well. With mortgage interest rates on the decline, homebuyers may find it more feasible to enter the market, leading to an increase in home sales and higher demand for real estate. This uptick in activity could stimulate construction jobs and related industries, further contributing to job creation and economic revitalization. However, it is crucial to consider that while lower rates tend to support these positive trends, factors such as consumer confidence and economic uncertainty can still influence overall outcomes.

In essence, the Federal Reserve’s interest rate cut has the potential to catalyze positive developments across various economic sectors, promoting increased borrowing, spending, and investment, ultimately benefiting the broader economy.

Future Outlook and Economic Trends

The recent decision by the Federal Reserve to cut interest rates was made with the anticipation of stimulating economic growth amid various challenges. As we look forward, several key economic indicators will play a crucial role in shaping the outlook of the economy. Unemployment rates remain a significant focus; historically, lower interest rates encourage investment and expansion, potentially leading to job creation. Should unemployment rates decline, it would signal a recovering economy, enhancing consumer purchasing power and confidence.

In addition to employment trends, inflation will be another critical factor to monitor. Lower interest rates typically lead to increased consumer spending and borrowing, which can, in turn, fuel inflationary pressures. The Federal Reserve aims to maintain a balance, ensuring inflation rates remain within an acceptable range while supporting economic growth. An uptick in inflation, monitored alongside wage growth, will inform the Fed’s future decisions on interest rate adjustments. Hence, it is essential to keep an eye on these trends.

Consumer confidence is also paramount in forecasting future economic conditions. When consumers feel optimistic about their financial outlook, they are more likely to spend and invest. This spending drives economic activity, ultimately influencing GDP growth. The interplay between interest rates and consumer sentiment will heavily impact the financial landscape, especially as businesses adjust to changing market dynamics.

Furthermore, as economic conditions evolve, the Federal Reserve may have to reassess its strategy regarding interest rates. Should inflation rise significantly, the Fed might consider reversing its course, leading to rate increases to stabilize the economy. Alternatively, if economic indicators point towards sluggish growth, further cuts could be feasible. Thus, ongoing monitoring of these economic indicators will be essential in determining the future path of the economy and the Federal Reserve’s policy moves.

You might also like:

- Major Fire at E-Land Fashion Logistics Center in Cheonan: A Detailed Overview

- New Talks Format Amid Continued Strikes in Odesa

- Seismic Shockwaves: The December 8 Earthquake and Tsunami in Japan

- Chelsea Secures Narrow Victory Over Tottenham: A Match Summary

- Inter Miami Wins MLS Cup: A Historic Triumph Led by Lionel Messi