Overview of the Market Sell-Off

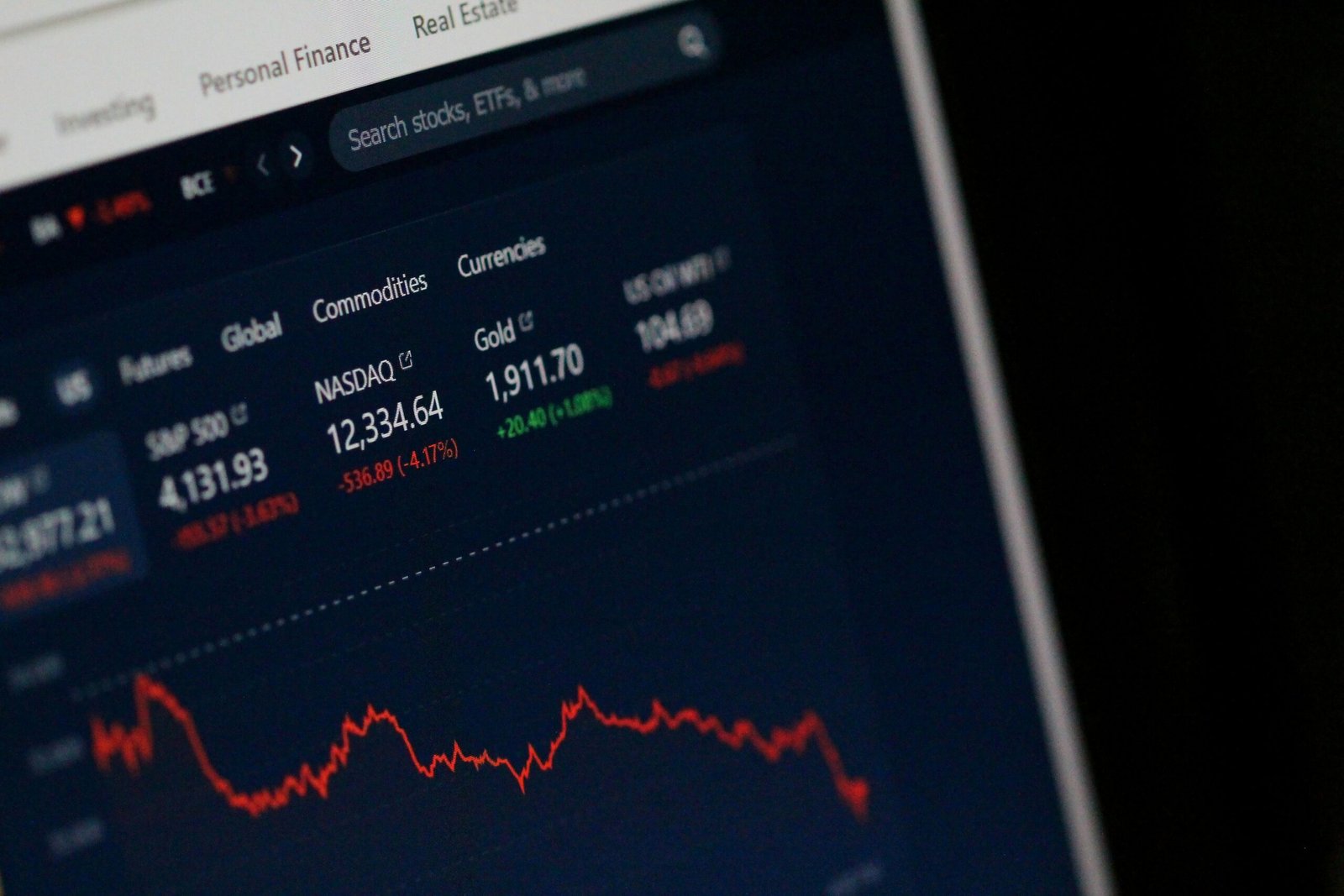

Recent developments in global stock markets have been marked by significant sell-offs, particularly concerning the U.S. and Asian markets. In the United States, major indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite have experienced noticeable declines. According to various reports, the S&P 500 alone saw a dip of over 5% in just a few trading sessions, reflecting heightened volatility and uncertainty among investors. Similar trends have emerged in Asian markets, where indices like the Nikkei 225 and Hang Seng Index faced substantial losses, contributing to an overall adverse trading environment.

The severe sell-off appears largely driven by escalating concerns surrounding inflation rates and rising interest rates. Recent economic data has indicated that inflation remains persistently high, prompting fears that central banks may implement more aggressive monetary policy tightening than previously anticipated. Investors are increasingly apprehensive about the potential implications this may have on corporate earnings and overall economic growth. This sentiment has led to a cautious approach among market participants, resulting in widespread liquidations across various sectors.

Moreover, geopolitical tensions and uncertainties in global supply chains have further exacerbated the situation, raising doubts about the stability of economic recovery post-pandemic. In light of these market dynamics, many investors are re-evaluating their portfolios, seeking safe-haven assets amidst declining stock prices. The overall sentiment has shifted from a growth-oriented outlook to one characterized by wariness and risk aversion, prompting shifts in investment strategies. As these concerns persist, the recovery of global stock markets remains uncertain, with many analysts closely monitoring economic indicators and signals from central banking authorities.

Impact on U.S. Markets

The recent sell-off in global stock markets has had a pronounced impact on U.S. markets, particularly evidenced by the performance of major indices such as the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite. Among these, the Nasdaq Composite registered the most significant decline, shedding 2.15% in value. This downturn can be attributed to a confluence of factors impacting investor sentiment, primarily revolving around economic indicators and the valuation of technology stocks.

One of the key contributors to the sell-off was the release of disappointing economic data, signaling potential weaknesses in the U.S. economy. Investors reacted with heightened caution, particularly in light of concerns regarding inflation and the Federal Reserve’s monetary policy stance. As inflation rates have remained stubbornly high, traders are monitoring any signals from the Federal Reserve regarding interest rate adjustments. Such uncertainties have led to increased volatility, adversely affecting market dynamics.

Furthermore, the valuation of tech stocks—often seen as bellwethers for market performance—has come under scrutiny. High growth technology companies experienced substantial fluctuations as investors reevaluated their future earnings potential against escalating economic headwinds. The Nasdaq Composite, which is heavily weighted towards technology firms, thus became a focal point of the downturn, with many tech stocks witnessing sharp declines in their share prices.

In this climate of uncertainty, investors have exhibited a tendency to flee from riskier assets, opting instead for more stable investments. This shift has not only influenced the direction of U.S. markets but has also underscored the interconnectedness of global financial systems. As the situation continues to evolve, the performance of U.S. indices will be closely watched for indications of recovery or further declines amidst ongoing economic volatility.

Asian Markets and their Response

In recent trading sessions, Asian stock markets have exhibited a pronounced reaction to the significant sell-off observed in global markets, primarily driven by rising concerns over economic stability and inflation. Key exchanges, including the Tokyo Stock Exchange, Hong Kong’s Hang Seng Index, and the Shanghai Composite, have all faced considerable declines, reflecting the apprehension permeating the investment landscape. The Nikkei 225 index, for instance, tumbled by over 3% as investors weighed the implications of potential interest rate hikes in response to escalating inflation rates in the United States.

The Hang Seng Index also faced significant pressures, dropping approximately 2.5% as uncertainties surrounding geopolitical tensions and the ongoing effects of the pandemic contributed to a bearish outlook. Similarly, mainland Chinese markets experienced selling pressure, influenced by a combination of regulatory concerns and sluggish economic data, which further eroded investor confidence. These declines have been indicative of a broader trend across the region, as market participants remain cautious amid the volatile global environment.

Moreover, the interconnectedness of global markets plays a crucial role in shaping investor sentiment in Asia. The reaction of Asian markets to movements in U.S. stock futures and consumer data often sets the tone for trading, creating a ripple effect. For instance, a dip in U.S. equities can lead to a cascade of selling in Asian markets, as investors reassess risk and adjust their portfolios accordingly. This synergy suggests that decisions made in the U.S. can have far-reaching implications, fostering a climate of uncertainty that drives Asian investors to reevaluate their strategies.

As the situation continues to unfold, it will be essential to monitor how these markets adjust in the wake of evolving global economic indicators and sentiment shifts, remaining vigilant to the persistent influence of U.S. market trends on Asia’s financial landscape.

Looking Ahead: What Investors Should Consider

As global stock markets grapple with significant sell-offs due to rising concerns, investors must reassess their strategies in light of evolving economic conditions. The current landscape is characterized by increasing inflation and shifting interest rates, which play a crucial role in market dynamics. Inflationary pressures can erode purchasing power and compress profit margins, causing investors to scrutinize corporate earnings more closely. Furthermore, higher interest rates, resulting from central banks’ tightening policies to combat inflation, can dampen economic growth and elevate the cost of borrowing, ultimately impacting stock valuations across various sectors.

The technology sector has been particularly vulnerable amidst these changes. Historically, tech stocks have commanded high valuations, predicated on the assumption of continued robust growth. However, with rising interest rates, the discounted cash flow valuations often used to justify these prices may come under scrutiny, pushing investors to reconsider their positions in established tech giants. In contrast, sectors that benefit from rising rates, such as financial services, may present new investment opportunities, as these companies often see improved margins on loans and increased profitability.

Moreover, it is prudent for investors to focus on diversification strategies. The volatility seen in the current market underscores the importance of holding a mix of asset classes, including equities, bonds, and alternative investments, to mitigate risks. Additionally, investors should consider sectors poised to thrive despite economic uncertainty, such as consumer staples and utilities, which historically exhibit resilience in downturns.

As the economic climate continues to evolve, investors must remain vigilant and adaptable. By keeping a close watch on inflation trends, interest rate adjustments, and sector performance, informed decisions can be made to navigate this turbulent investing environment effectively.