Overview of Nvidia’s Journey to Trillion-Dollar Valuation

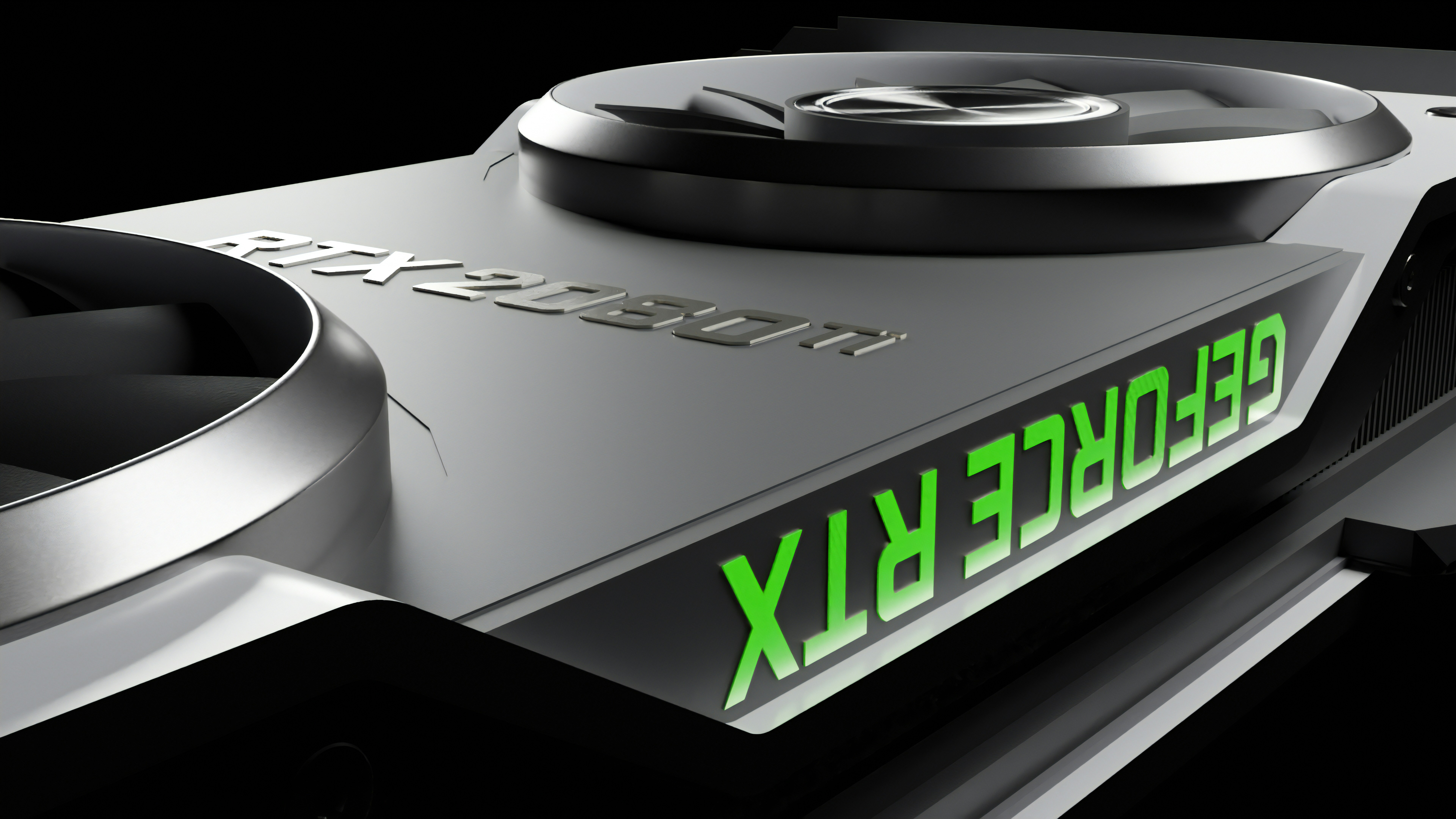

Nvidia’s evolution from a graphics card manufacturer to a leading player in artificial intelligence (AI) and data center technologies underscores its remarkable growth trajectory. Founded in 1993, the company’s early years were marked by its commitment to developing high-performance graphics processing units (GPUs), which became essential as gaming and multimedia capabilities advanced. A pivotal moment in Nvidia’s journey was the launch of the GeForce series in 1999, which solidified its position in the gaming industry and laid a strong foundation for future innovations.

As the digital landscape shifted towards AI and machine learning, Nvidia strategically repositioned itself to capitalize on emerging market demands. The introduction of the CUDA programming model in 2006 enabled developers to utilize GPUs for general-purpose computing, expanding Nvidia’s reach beyond gaming into scientific research and deep learning. This innovation was instrumental in showcasing the GPU’s versatility, establishing Nvidia as a critical player in AI development.

Key partnerships further played a role in Nvidia’s ascent to a valuation nearing $5 trillion. Collaborations with companies such as Tesla for autonomous driving technology and deep engagement with major cloud service providers have allowed Nvidia to penetrate numerous industries, enhancing its market share. The growing importance of data centers, particularly for AI workloads, has positioned Nvidia’s data center solutions as essential components for organizations seeking to harness the power of artificial intelligence.

Moreover, the consistent introduction of ground-breaking products, including the A100 Tensor Core GPU and the recent Hopper architecture, has kept Nvidia at the forefront of technological advancements. The company has adeptly navigated various market shifts, ensuring that it remains a leading figure in both the gaming and AI sectors. Through a combination of innovation, strategic partnerships, and a keen understanding of market needs, Nvidia has transformed into a powerhouse with aspirations of reaching a trillion-dollar valuation.

The Factors Driving Nvidia’s Valuation

Nvidia’s ascension towards a nearly $5 trillion valuation can be attributed to a confluence of multiple factors that underscore its pivotal position in technology sectors such as gaming, artificial intelligence (AI), and cloud computing. One of the primary drivers of Nvidia’s remarkable valuation is the skyrocketing demand for Graphics Processing Units (GPUs), primarily fueled by the gaming industry’s continuous evolution. As gaming becomes increasingly sophisticated and immersive, the need for high-performance GPUs has surged, allowing Nvidia to capture a substantial market share due to its innovative product offerings.

Moreover, Nvidia’s advancements in AI have solidified its reputation as a leader in the technology sector. The company’s GPUs are not only pivotal in gaming but also serve as crucial components in data centers for AI processing. The efficiency and performance provided by Nvidia’s product line have set new benchmarks, attracting businesses looking to harness AI for various applications. This growing integration of AI technologies spans across sectors, further enhancing Nvidia’s market dominance and ultimately contributing to its enhanced valuation.

In addition to gaming and AI, Nvidia’s strategic investments in cloud computing have bolstered its financial performance. Companies worldwide are shifting to cloud solutions, which often rely on powerful GPUs for efficient data processing and storage. Nvidia has positioned itself as a key player in this space, ensuring that its products cater to the rising demand within the cloud computing market.

Another noteworthy aspect of Nvidia’s growth trajectory is its initiatives in the automotive sector. The company’s foray into self-driving technology and vehicle automation is indicative of its foresight in anticipating future technology trends. By investing in emerging technologies and capitalizing on multiple revenue streams, Nvidia effectively strengthens its market presence, driving further valuation growth. Thus, the interplay of these diverse factors illustrates the reasons behind Nvidia’s impressive journey towards becoming a technological powerhouse.

Implications of Reaching a $5 Trillion Market Cap

The prospect of Nvidia reaching a $5 trillion market capitalization marks a significant milestone not only for the company but also for the technology and semiconductor sectors as a whole. Achieving this unprecedented valuation could reshape investor sentiment, encouraging a shift toward greater optimism in the tech industry. Investors often perceive high market capitalizations as indicators of sustainable growth potential; thus, Nvidia’s achievement may inspire increased allocations towards other tech stocks, reinforcing an overall bullish trend in equity markets.

Furthermore, Nvidia’s surge toward a $5 trillion market cap could induce strategic realignments among semiconductor companies. As Nvidia continues to innovate and set industry benchmarks in artificial intelligence and graphics processing, competitors may be compelled to accelerate their own research and development initiatives. This fervent race for technological supremacy may lead to heightened investments in emerging technologies, such as autonomous systems and quantum computing, further stimulating industry growth.

The competitive landscape could also experience significant changes. Smaller semiconductor firms may face challenges in capturing market share against a behemoth like Nvidia, which boasts substantial resources and brand recognition. As the company’s market dominance grows, other industry players may need to either innovate at a faster pace or explore mergers and acquisitions to remain competitive. Consequently, Nvidia’s ascendance could contribute to a more consolidated semiconductor industry, whereby only the most adaptable and technologically advanced firms thrive.

On a macroeconomic scale, the achievement of a $5 trillion market cap could influence market dynamics and investor behavior globally. Institutional investors may reassess their portfolios, adjusting asset allocations in response to the broader implications of Nvidia’s success. Enhanced liquidity and increased price volatility may become commonplace, reflecting a changing landscape characterized by aggressive competition and innovation within the semiconductor arena.Thus, the potential implications of Nvidia’s market cap achievement are manifold, affecting individual investors, industry players, and the broader economic environment alike.

Future Outlook for Nvidia and the Semiconductor Industry

Nvidia stands at a significant crossroads as it approaches a historic valuation of $5 trillion. The semiconductor industry is witnessing rapid advancements, thus shaping Nvidia’s trajectory in the coming years. Critical to this growth will be the ongoing demand for advanced computing technologies, driven primarily by artificial intelligence (AI) and machine learning applications. These technologies rely heavily on the robust performance of GPUs, which are Nvidia’s forte. As industries increasingly adopt AI capabilities, the demand for Nvidia’s products is expected to surge, potentially solidifying its position as a market leader.

However, this period of anticipated growth is not without challenges. The semiconductor industry faces ongoing supply chain disruptions and geopolitical tensions, which can impact production and delivery schedules. Additionally, competition from other technology companies is escalating, with several players investing heavily in their semiconductor capabilities. Companies such as AMD and Intel are continuously looking to innovate, which poses a direct challenge to Nvidia’s market share. Moreover, as the semiconductor manufacturing process becomes more intricate, sustaining high levels of productivity and efficiency will be crucial for all players in the market.

The future outlook for Nvidia also involves navigating environmental sustainability concerns, as the production processes within the semiconductor industry can be resource-intensive. The acceleration towards green technologies and energy-efficient processes is expected to shape operational strategies significantly. Innovations in chip designs that offer improved performance while reducing energy consumption will not only optimize costs but will also appeal to an increasingly eco-conscious market.

Ultimately, Nvidia’s growth trajectory will be influenced by its ability to adapt to the rapidly changing technological landscape, maintain its competitive edge, and strategically leverage emerging opportunities within the semiconductor sector. This adaptive capacity will likely dictate the sustainability of its remarkable growth and assist in overcoming the hurdles posed by evolving market conditions.